23+ mortgage deduction tax

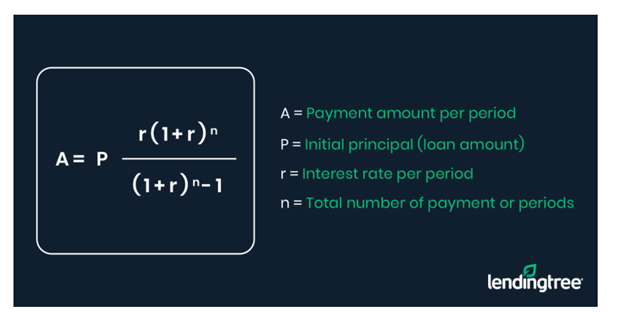

Limiting the home mortgage interest. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years.

What To Bring To A Tax Appointment Tax Checklists Forms You Must Have The Handy Tax Guy

Web There are 3 Treasurer Tax Collector Offices in Rock County Wisconsin serving a population of 161226 people in an area of 718 square milesThere is 1 Treasurer Tax.

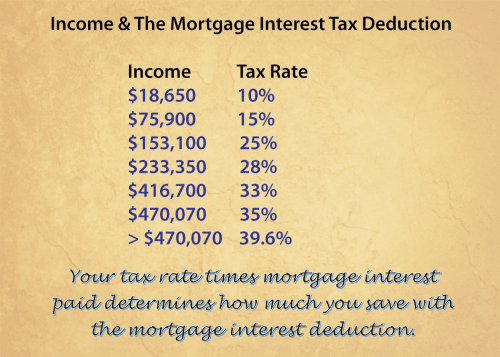

. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. How to determine the amount of mortgage interest. For tax years before 2018 the interest paid on up to 1 million of acquisition.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Web The deduction equals 3000 one-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which ever.

Web Mortgage Interest Deduction Limit. You paid 4800 in. Married filing jointly or qualifying widow er.

Homeowners who are married but filing. Web The IRS places several limits on the amount of interest that you can deduct each year. Taxes Can Be Complex.

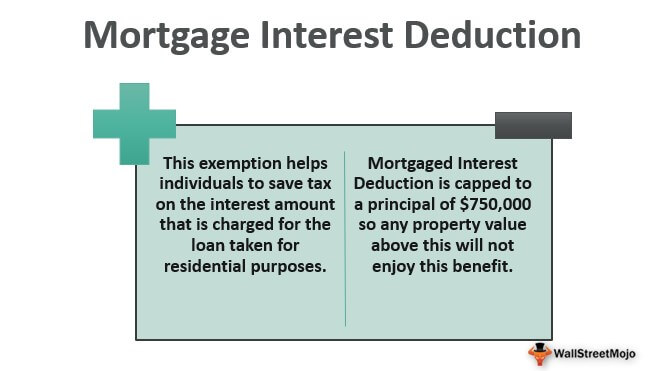

Web Likewise you can deduct property taxes associated with homeownership which includes state and local taxes. Find content updated daily for how to figure out your taxes. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Taxes Can Be Complex. Single or married filing separately 12550. The terms of the loan are the same as for other 20-year loans offered in your area.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web For 2021 tax returns the government has raised the standard deduction to. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

If youre single or married and filing jointly you can. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

I am trying to complete my taxes but the 1098 Mortgage Interest area says it is not. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. If you go into the forms and look at the worksheets adding the date the loan was paid off in 2022 and.

Web If your itemized deductions arent greater than the standard deduction you may want to skip itemizing and claim the standard deduction instead. Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent. It seems to be broken again for 2022 tax year.

Web A standard deduction reduces your taxable income by a set amount depending on your income age filing status and other factors whereas with itemized. State Filing Fee. Ad Looking for how to figure out your taxes.

Say you have a 200k mortgage Jan-June 2022 then you sell that house buy a new one and have an 800k mortgage from July 1-present. Obtain the information you need in Step 1. Web IRS Publication 936.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Desktop Premier Says Mortgage Interest Deduction Area not ready yet for 2022.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home. Web There are 3 Treasurer Tax Collector Offices in Green County Wisconsin serving a population of 36869 people in an area of 584 square milesThere is 1 Treasurer Tax. For taxpayers who use.

Web Basic income information including amounts of your income. Web Offer is valid for a limited time on federal tax returns e-filed by 41823 at 1159 pm. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

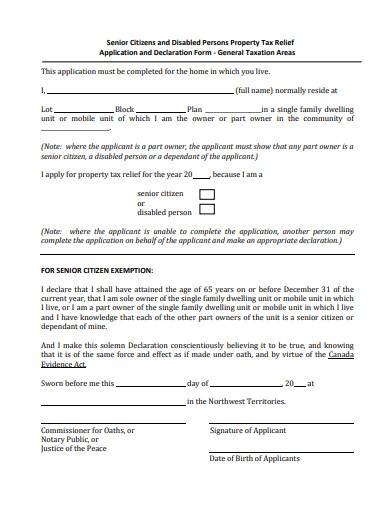

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. Web The mortgage interest amount on Form 1098 yearly.

The New Home Mortgage Interest Deduction Mark J Kohler

The Home Mortgage Interest Deduction Lendingtree

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction Save When Filing Your Taxes

Overview Of Exemptions Deductions Allowances And Credits In The Download Table

Qbv129ggl9b7gm

Mortgage Interest Deduction Rules Limits For 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

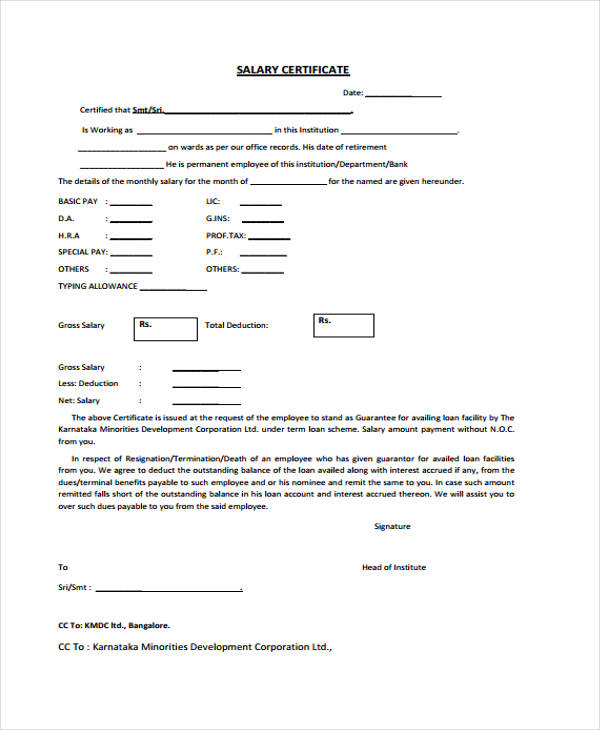

23 Salary Certificate Formats Pdf Word

Top 5 Tax Deductions For New Homeowners In Utah Liberty Homes

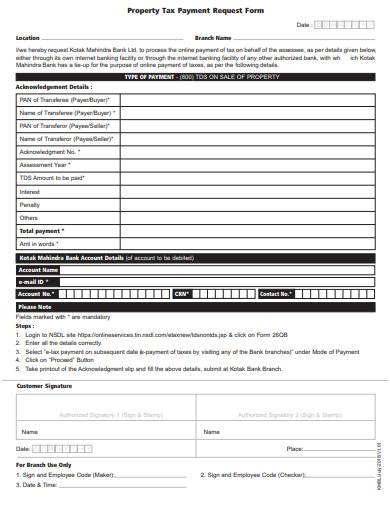

Free 10 Property Tax Samples In Pdf Ms Word

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Save When Filing Your Taxes

Free 10 Property Tax Samples In Pdf Ms Word

Mortgage Interest Deduction Save When Filing Your Taxes

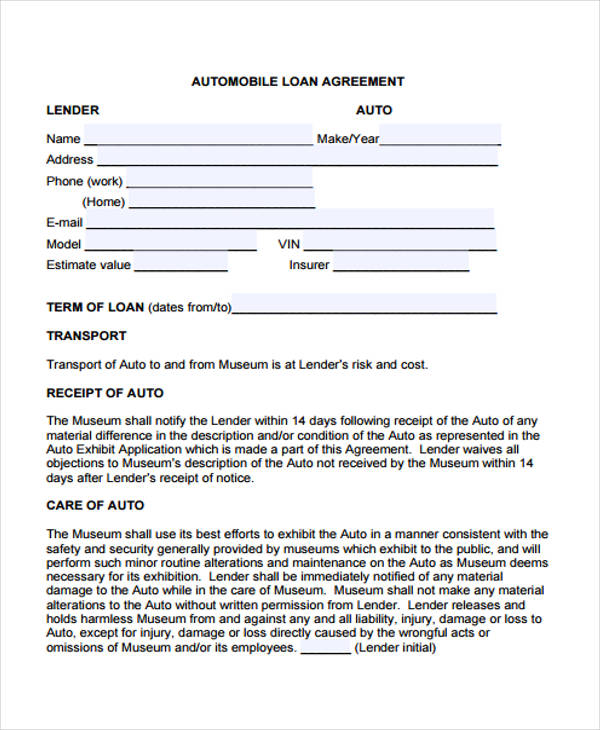

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

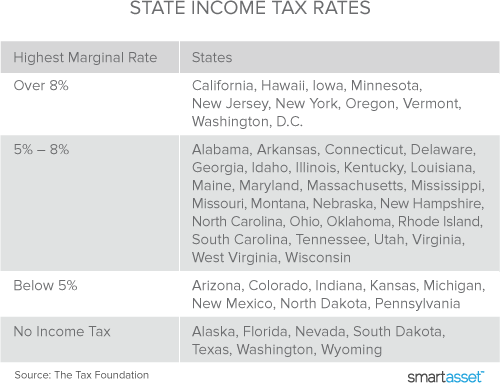

Mortgage Interest Tax Deduction Smartasset Com